Stochastic RSI (STOCH-RSI)

The Stochastic RSI (StochRSI) is a technical indicator that measures the momentum of the Relative Strength Index (RSI), rather than price itself. It is created by applying the Stochastic Oscillator formula to a set of RSI values. The result is a more sensitive oscillator that fluctuates between 0 and 100, designed to identify short-term overbought and oversold conditions with greater frequency than the standard RSI. This increased sensitivity allows traders to pinpoint potential entry and exit points within a broader trend identified by the RSI.

Function Syntax

=STOCH_RSI(data, period, smoothing) data(array):

Range of columns containing the date, Open, high, Low, close, volume data.period(number):

The number of periods (days) used to calculate the RSI.smoothing(number): The number of periods used to smooth the %K values into the %D signal line.

Returns:

A three-column array of dates and their corresponding %K and %D values.

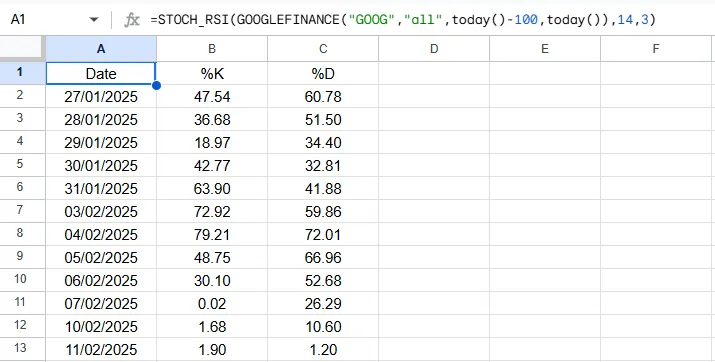

Output Example

Below is an example of the resulting array when applying the custom =STOCH_RSI() function.