Money Flow Index (MFI)

The Money Flow Index (MFI) is a momentum indicator that incorporates both price and volume data to measure buying and selling pressure. Often referred to as the “volume-weighted RSI,” the MFI is used to identify overbought or oversold conditions by analyzing the intensity of money flowing into and out of a security. The indicator oscillates between 0 and 100, where readings above 80 typically signal an overbought market and readings below 20 suggest an oversold market. Divergences between the MFI and price can also be used to anticipate potential trend reversals.

Function Syntax

=MFI(data, period) data(array):

Range of columns containing the date, Open, high, Low, close, volume data.period(number):

The number of periods (days) used to calculate the MFI. Typically 14 periods

Returns:

A two-column array of dates and their corresponding MFI values

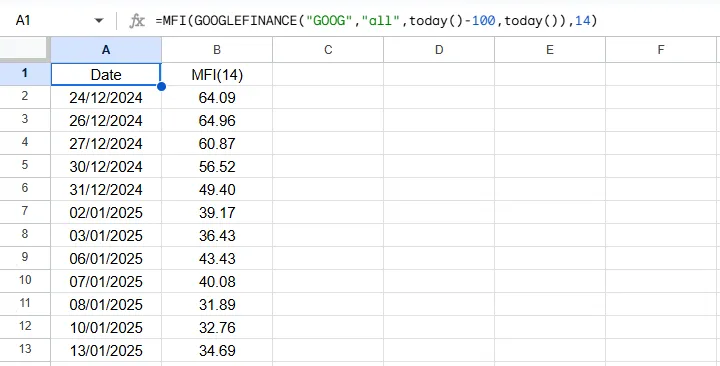

Output Example

Below is an example of the resulting array when applying the custom =MFI() function.