Bollinger Bands (BB)

Bollinger Bands are a technical analysis tool developed by John Bollinger, consisting of three lines plotted in relation to a security’s price. The middle line is a Simple Moving Average (SMA), while the upper and lower bands are typically set two standard deviations above and below the SMA. The primary purpose of Bollinger Bands is to measure market volatility by showing how the bands widen during periods of high volatility and contract (or ‘squeeze’) during periods of low volatility. This allows traders to gauge whether prices are relatively high or low on a dynamic basis.

Function Syntax

=BOLLINGER_BANDS(data, period, mutiplier ) data(array):

Range of columns containing the date, Open, high, Low, close, volume data.period(number):

The number of periods (days) used to calculate the Simple Moving Average and standard deviation. Typically 20 periods.multiplier(number):

The multiplier applied to the standard deviation to set the width of the bands. Typically 2.

Returns:

A four-column array of dates and their corresponding SMA, Upper Band and Lower Band values.

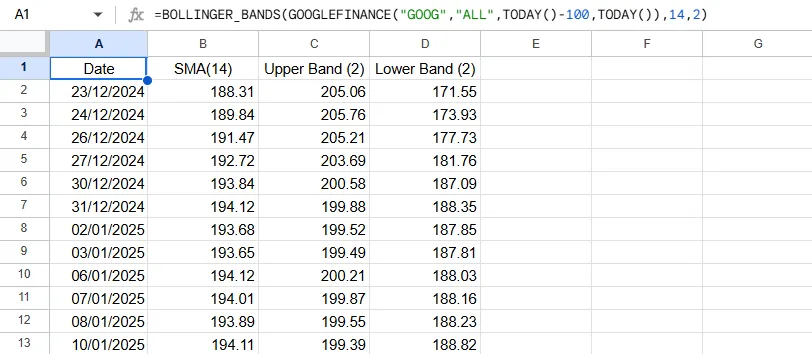

Output Example

Below is an example of the resulting array when applying the custom =BOLLINGER_BANDS() function.