Stochastic (STOCH)

The Stochastic Oscillator, developed by George C. Lane, is a popular momentum indicator that compares a particular closing price of a security to a range of its prices over a certain period of time. It is based on the premise that as prices rise, closing prices tend to be closer to the high of the recent range, and as prices fall, they tend to be closer to the low. The indicator oscillates between 0 and 100 and is primarily used to identify overbought (typically above 80) and oversold (typically below 20) conditions, which can signal potential momentum shifts and trend reversals..

Function Syntax

=STOCH(data, period) data(array):

Range of columns containing the date, Open, high, Low, close, volume data.period(number):

The number of periods (days) used to calculate the Stochastic Oscillator.

Returns:

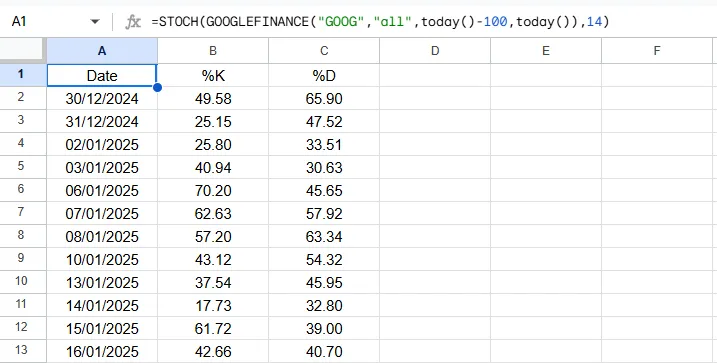

A three-column array of dates and their corresponding %K and %D values.

Output Example

Below is an example of the resulting array when applying the custom =STOCH() function.