Average True Range (ATR)

The Average True Range (ATR) is a technical analysis indicator, developed by J. Welles Wilder Jr., used to measure market volatility. It quantifies the degree of price movement by taking the average of the ‘true range’ over a specified number of periods. A higher ATR value indicates higher market volatility, while a lower ATR signifies a period of lower volatility or consolidation. Importantly, ATR does not provide an indication of price direction, only the magnitude of its movement.

Function Syntax

=ATR(data, period) data(array):

Range of columns containing the date, Open, high, Low, close, volume data.period(number):

Number of (periods) days over which to calculate the ATR.

Returns:

A two-column array of dates and their corresponding ATR values.

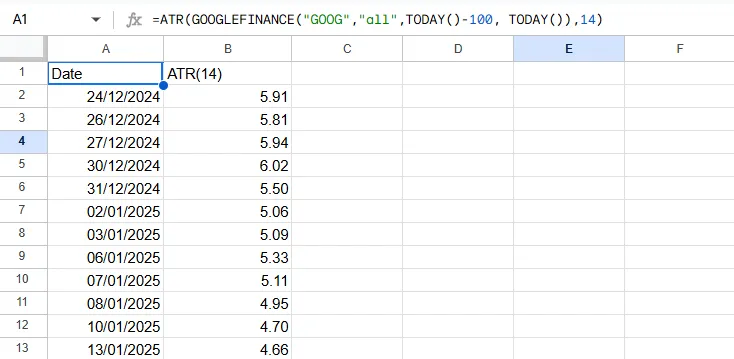

Output Example

Below is an example of the resulting array when applying the custom =ATR() function.