Simple Moving Average (SMA)

The Simple Moving Average (SMA) is a fundamental technical analysis tool that calculates the average price of a security over a specified number of periods. Its primary purpose is to smooth out price data by filtering short-term volatility, or “noise,” making it easier for traders to identify the direction of the underlying market trend. The SMA is calculated by summing the closing prices for a given period and dividing by that number of periods, giving equal weight to all data points and providing a true, unweighted average price for that timeframe.

Function Syntax

=SMA(data, period) data(array):

Range of columns containing the date, Open, high, Low, close, volume data.period(number):

Number of periods (days) over which the RSI is calculated

Returns:

A two-column array of dates and their corresponding SMA values.

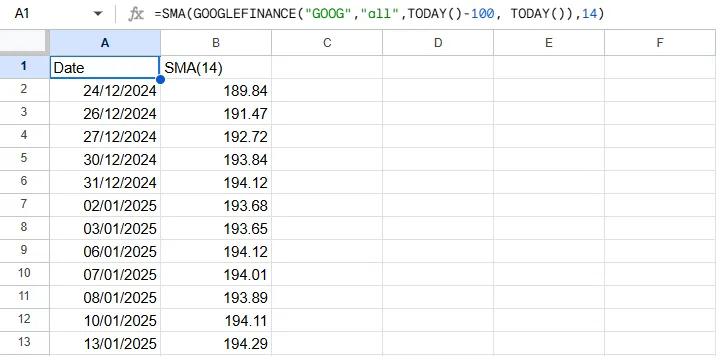

Output Example

Below is an example of the resulting array when applying the custom =SMA() function.