Standard Deviation (STDEV)

Standard Deviation is a statistical measure used in technical analysis to quantify market volatility. It works by calculating the dispersion of a security’s closing prices from its Simple Moving Average (SMA). A higher standard deviation value indicates that prices are more spread out, signifying greater volatility and market uncertainty. Conversely, a lower value signifies that prices are tightly clustered around the average, indicating lower volatility. It serves as the fundamental building block for other key indicators, most notably Bollinger Bands, which are plotted at standard deviation levels above and below a moving average.

Function Syntax

=STDEV_INDICATOR(data, period) data(array):

Range of columns containing the date, Open, high, Low, close, volume data.period(number):

Number of (periods) days over which to calculate the Standard Deviation.

Returns:

A two-column array of dates and their corresponding Standard Deviation values.

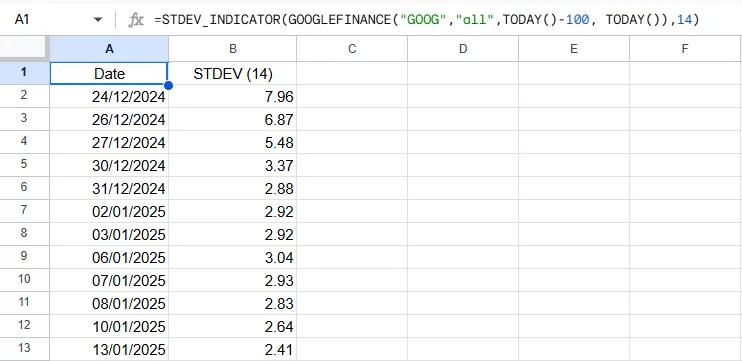

Output Example

Below is an example of the resulting array when applying the custom =STDEV_INDICATOR() function.