Relative Moving Average (RMA)

The Relative Moving Average (RMA) is a type of smoothed moving average introduced by J. Welles Wilder Jr., serving as a core component in his famous indicators like the Relative Strength Index (RSI) and Average True Range (ATR). Similar to an Exponential Moving Average (EMA), the RMA’s primary function is to smooth price data to clarify the direction of the underlying trend. Its unique characteristic is its specific smoothing formula, which provides a consistent filtering effect that helps reduce market noise without the significant lag of a Simple Moving Average (SMA).

Function Syntax

=RMA(data, period) data(array):

Range of columns containing the date, Open, high, Low, close, volume data.period(number):

Number of periods (days) over which the RMA is calculated

Returns:

A two-column array of dates and their corresponding RMA values.

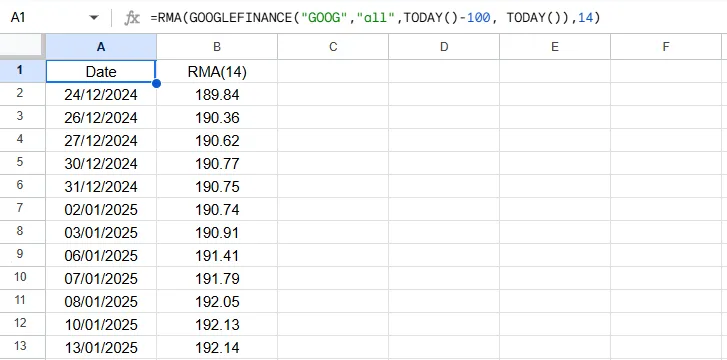

Output Example

Below is an example of the resulting array when applying the custom =RMA() function.