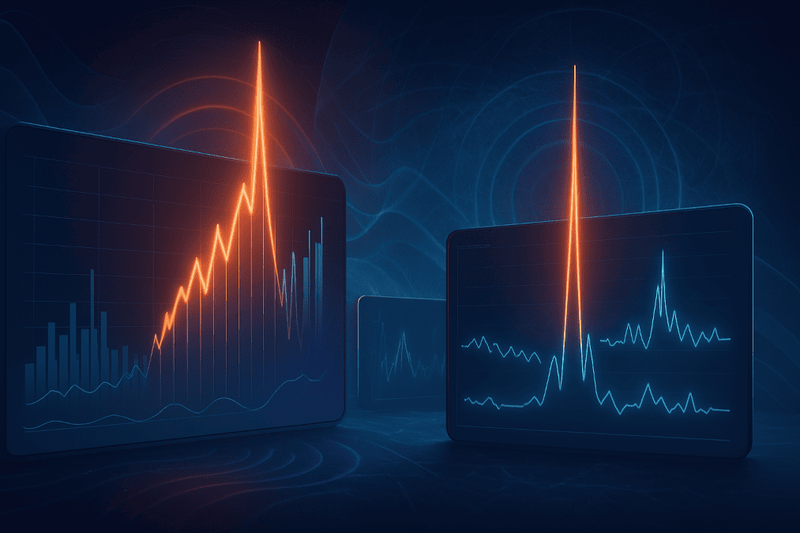

Volatility Spike Indicators: A Better Way to Spot Major Price Moves

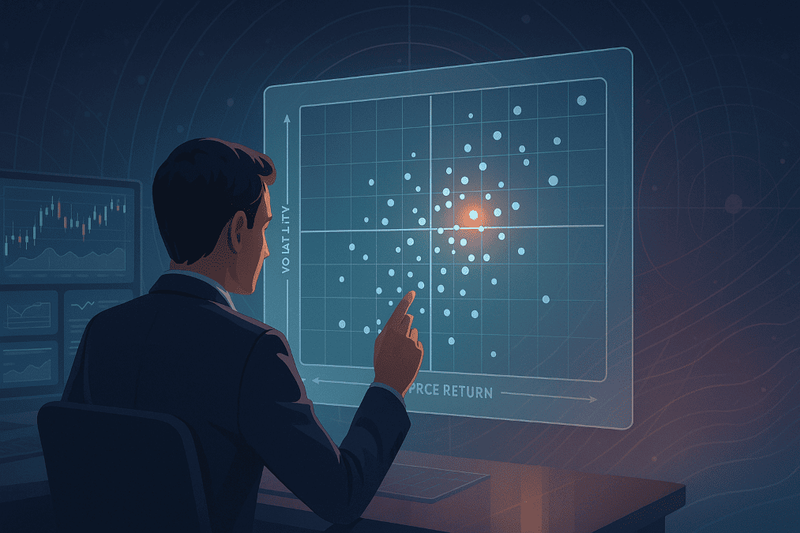

To measure price movements, it’s essential to consider volatility. Daily returns alone lack meaning without context; only by analyzing recent price history can we understand the true significance of a price change.