A Practical Look at Implementing an ATR-Stop loss

As traders, one of the first key lessons we quickly learn is the importance of the stop-loss.

I like to think of a stop-loss as the point where my trading system tells me that my initial entry setup’s probabilities and risk-reward are no longer valid. Signalling, that continuing with the trade from this point may carry additional risk, prompting the question:

Do you want to continue or exit?

But then, how do we actually set a stop-loss?

How do we determine the right level to exit the market?

Is there a “perfect” stop-loss level?

The truth is a simple “No”. There isn’t a holy grail for stop-losses and that’s just the unpredictable nature of the market.

However, we can still use tools to contextualize the fluctuations around our entry levels. One such tool is the Average True Range (ATR), which helps us establish stop levels in line with market volatility, where the stop level is based on the volatility of the assets rather than using a fixed percentage, giving a more dynamic approach.

There are countless ways to apply an ATR stop to a trading system. Here, I’ll walk through the most common approaches, which can be seen as building blocks for further refinement.

There are countless ways to apply an ATR stop to a trading system. Here, I’ll walk through the most common approaches, which can be seen as building blocks for further refinement.

Applying ATR-Based Stop-Losses

ATR Stop-loss Components

An ATR stop consists of two key parts:

- The ATR Value – A measure of the typical volatility in price.

- The Multiplier – is a factor used to adjust the Average True Range (ATR) by multiplying the ATR by a specific value. A higher multiplier sets a wider stop-loss, while a lower multiplier creates a tighter stop-loss. Think of the multiplier as fine-tuning knob that helps align the stop-loss with your personal risk tolerance and the asset’s volatility.

General Stop-Loss Formula

-

For a long position:

Stop-loss level = Entry Price – (ATR Value * Multiplier) -

For a short position:

Stop-loss level = Entry Price + (ATR Value * Multiplier)

Example

Let’s say:

-

ATR = 4

-

Previous close = 125

-

Entry (long) = 127

-

Multiplier = 1

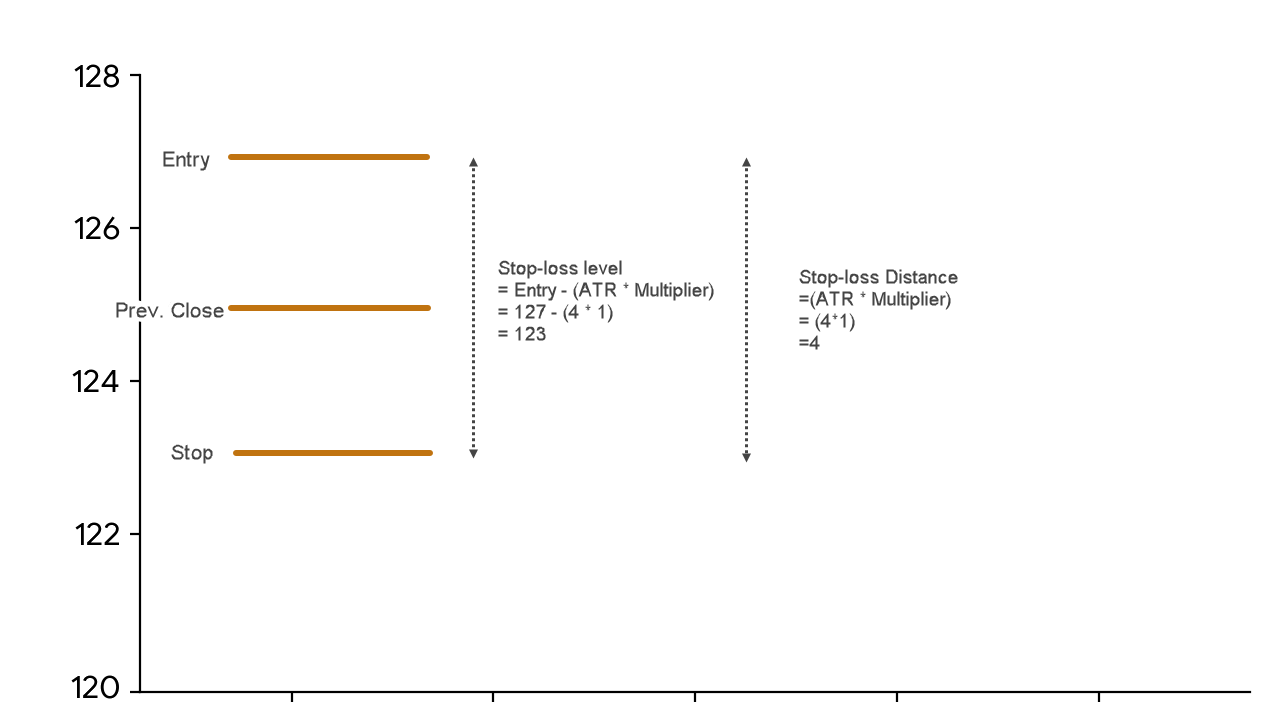

Method 1 - Stop-Loss Based on Entry Price

The stop-loss is calculated relative to your entry price:

= Stop-loss level

= Entry Price – (ATR * Multiplier)

= 127 – (4 * 1)

= 123

Key Consideration:

Since the ATR value is historical based measure ( i.e. calculated on previous close price)

Using the entry price to set the stop-loss may result in a tighter stop-loss.

In a volatile market, this could mean the stop is tighter than expected based on average fluctuations, potentially leading to an earlier exit from the trade.

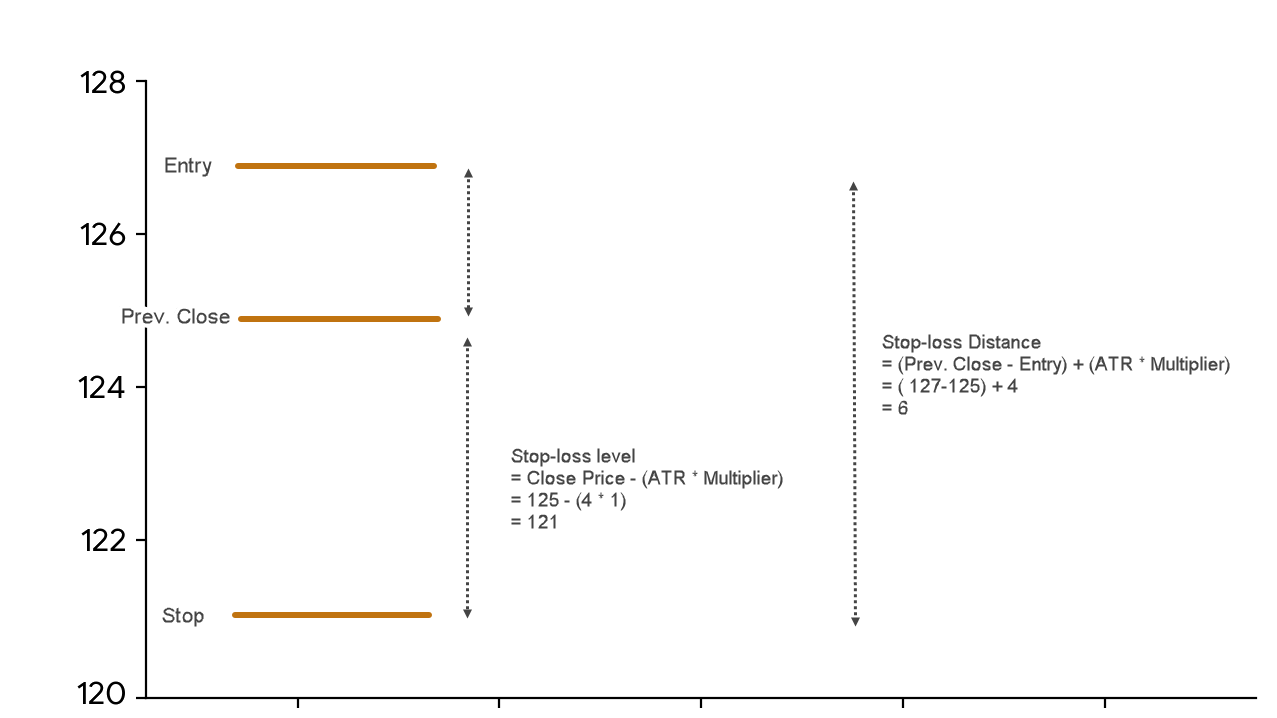

Method 2 Stop-Loss Based on Close Price

This approach uses the previous close as a reference point for setting the stop-loss:

= Stop-loss level

= Close Price – (ATR * Multiplier)

= 125 – (4 * 1)

= 121

Key Consideration:

Using the close price as the stop reference can create a wider stop-loss if your entry is far from the close. This increases the distance between your entry and stop, which may require a larger price move to maintain a favourable risk-reward ratio.

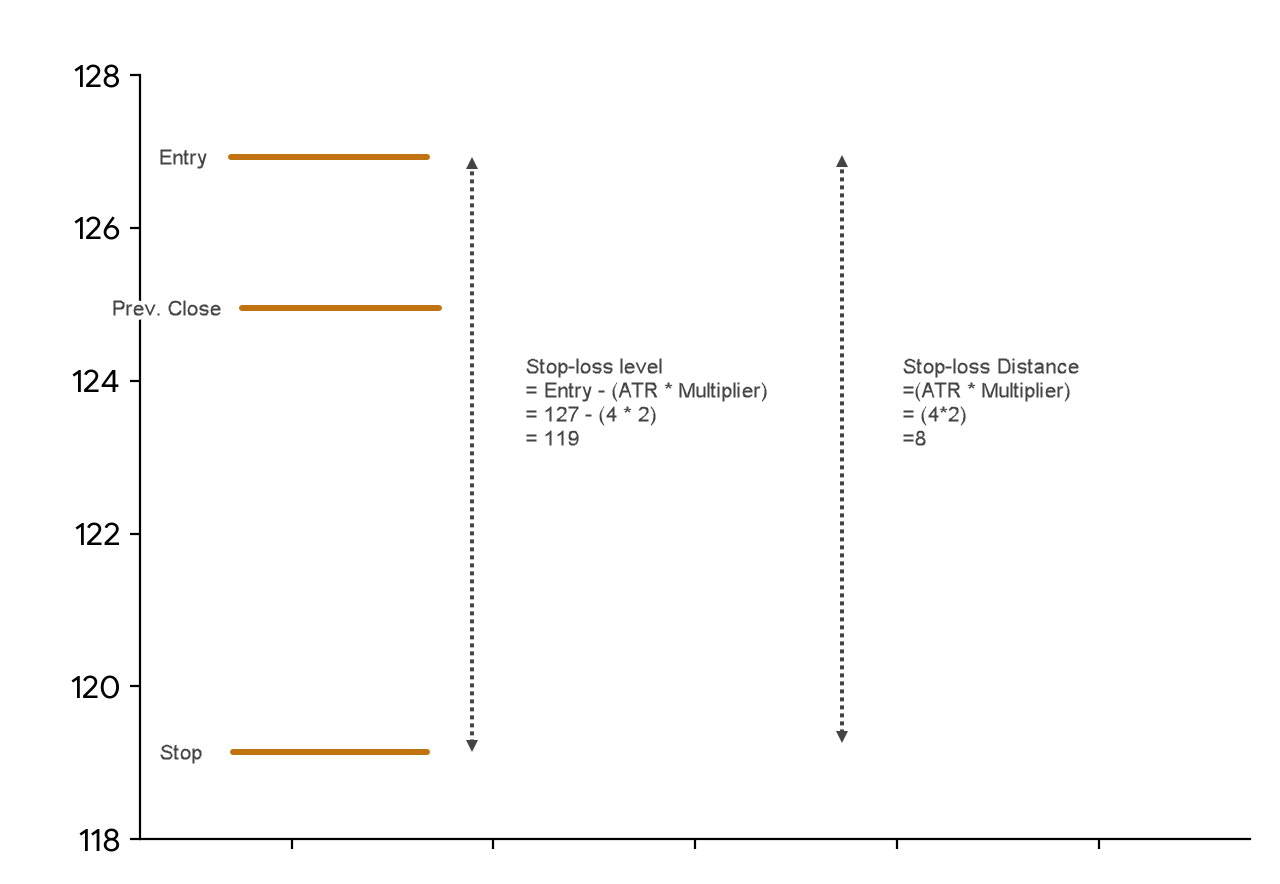

Applying the ATR Multiplier

Continuing with the Method 1 example, a stop loss level with an ATR Multiplier of 2 would be calculated as follows:

=Stoploss Level

=Stoploss Level

=Entry Price – (ATR * Multiplier)

=127 – (4 * 2)

=119

By applying a multiplier to the base ATR value, the distance increased making it less likely for normal market noise to trigger an early exit. This is where the nuance of trading comes in.

Remember how we started with a simple question: How do you set a stop-loss?

That led us to the ATR system, and then to the idea of adjusting the stop with a multiplier to better manage volatility. But then a new question arises:

What’s the ideal multiplier?

That’s the nature of developing a trading edge. It’s a process of continuous refinement, adjusting, testing, and evolving your system to find what works best for your strategy, asset class, and risk profile.

Happy Trading!